Of course, if you withhold the security deposit to cover damages caused by the tenant, the cost of repairing such damage will be deductible, and offset the income from the forfeited security deposit.

If you eventually keep part or all of the security deposit because the tenant does not live up to the terms of the lease, you must include that amount as income on your tax return for the year in which the lease terminates. What if I pocket some of the security deposit? In contrast, deposits for the last month's rent are taxable when you receive them, because they are really rents paid in advance. Security deposits are not included in income when you receive them if you plan to return them to your tenants at the end of the lease. For example, if your renters place their January 2022 checks in your mailbox late in December of 2022, you cannot avoid reporting the rent as 2022 income by simply leaving the checks in your mailbox until January 2023. This means the funds are available to you even if you haven't taken possession of them.

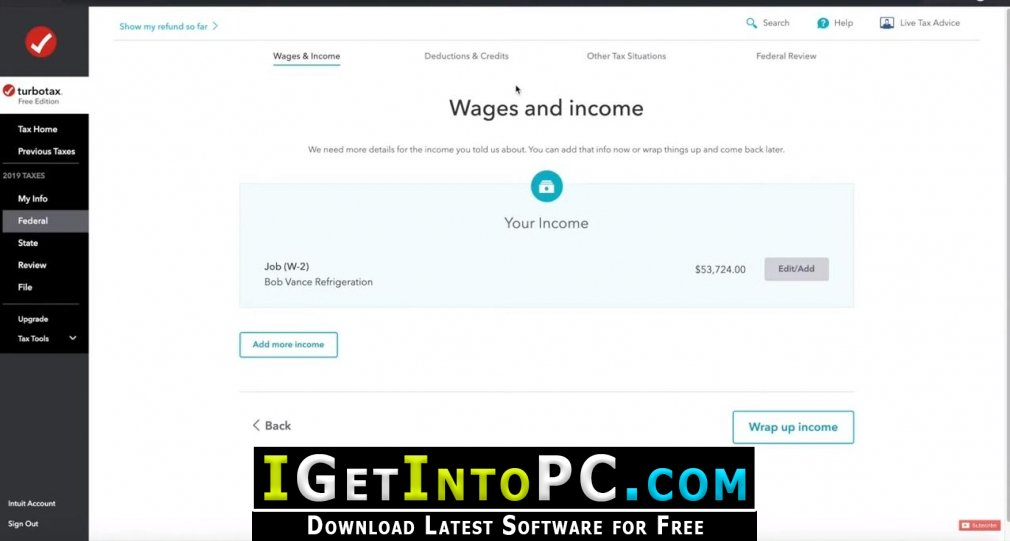

In general, you must report all income on the return for the year you actually receive it, even though it may be credited to your tenant for a different year. Schedule E is then filed with your Form 1040.You report rental income and expenses on Schedule E, Supplemental Income and Loss.You're allowed to reduce your rental income by subtracting expenses that you incur to get your property ready to rent, and then to maintain it as a rental. Yes, rental income is taxable, but that doesn't mean everything you collect from your tenants is taxable. Taxpayers in similar circumstances find themselves asking these questions: Is rental income taxable? But as first-time landlords, they don't know whether they need to report the rent they receive on their tax return and, if so, whether any of the money they spent to get the condo ready to rent is deductible.ĭoes this story sound familiar? If so, you're not alone. Because the rental market in their area is improving, they decide that instead of selling Sue's condo, they could make some money by holding on to it and renting it out. When you rent out a house or condo, taxes can be a headache.Īfter buying a condo and living in it for several years, Sue meets Steve, marries him and moves into his house. You can deduct ordinary and necessary expenses you incur to place our rental property in service, manage it and maintain it, even if the property is temporarily vacant.However, deposits for the last month's rent are taxable when you receive them. If you plan to return security deposits to your tenants, you don’t have to report them as rental income.You’re generally required to report your rental income on the return for the year you actually receive it, even if it’s credited to your tenant for a different year.

Rental income is taxable, and you should report your rental income and any qualifying deductions on Schedule E, Supplemental Income and Loss.

0 kommentar(er)

0 kommentar(er)